Critical Energy Infrastructure in focus! Despite recent advancements in initiatives and the strengthening of legal frameworks, the protection of critical energy infrastructure remains fraught with significant challenges. A new report for FSR

Russia’s gas exit from Europe. Motivations, rationale, unexpected issues for the EU, possibilities and limits for Russia-China relations. A podcast with Andris Piebalgs at Florence School of Regulation

Follow up: implications of Russia’s invasion of Ukraine on international oil and gas markets

Can an oil embargo against Russia work? what are the challenges and possible effects? Insights to the Energy Monitor May 2022

What happens to gas from Russia? Why Bulgaria and Poland were the first on the list? of course, contracts expired the first, but? Article in the Financial Times about. Possibly, Russian political establishment warms up the public opinion to support the gas interruptions? See the commentary in Euractiv , March 2022.

In turn, EU’s efforts to phase out Russian gas offer opportunities for Africa, discussion on CBC Azerbaijan (in Russian)

A quick look on Gazprom’s capacity booking via Ukraine and Yamal-Europe: in the current situation, daily capacity booking of pipeline networks by Gazprom to ship gas to Europe provokes market reaction and price movements. But how the uncertainty in gas markets emerged? The problem is discussed in an article by Energy Post January 2022

No quick solutions from the gas crisis! Mid-term vision is necessary!

An interview with Estonian business newspaper (Russian version): no quick solution to the gas crisis! On Commission’s Energy Toolbox joint gas purchases and strategic storages don’t solve the global price dynamics. Instead, one needs to think over incentivising LNG imports and changing gas impact on power markets.

There is a need to combine renewable energy support with system reliability, so far the two are disconnected in the policy discussion.

Full version in Russian

Commentaries about the current gas crisis: Gas crunch and lessons learned for Energy Post , commentary for Euractiv Discussion on TV Dubai and CBC Azerbaijan (in Russian) and Asharq Business Dubai (in Arab)

Interview for the Natural Gas World: Energy beats politics for European businesses regarding Russia.

Joint analysis with Gelbert et al LNG markets perspectives: historical significance of the development of the American market as well as emphasizes major trends towards increasing competitiveness of LNG supplies, growing competition between Russian gas suppliers, and a dynamic favorable to gas-carbon price connectiveness.

Commentary on Nord Stream 2: political and legal implications, text for RiEnergia (Italian): Il futuro del Nord Stream 2, tra interessi geopolitici ed economici

Watch the podcast with Volterra Fietta LLP! International Law firm Volterra Fietta organised a webinar The Energy Charter Treaty: is it still fit for purpose and how could it be improved?

Watch this space: article in The Energy Post in response to earlier critique on the Energy Charter. The Energy Charter Treaty needs updating, but remains a valuable tool for the transition. Interview for Natural Gas World Magazine ‘Updating the Energy Charter’.

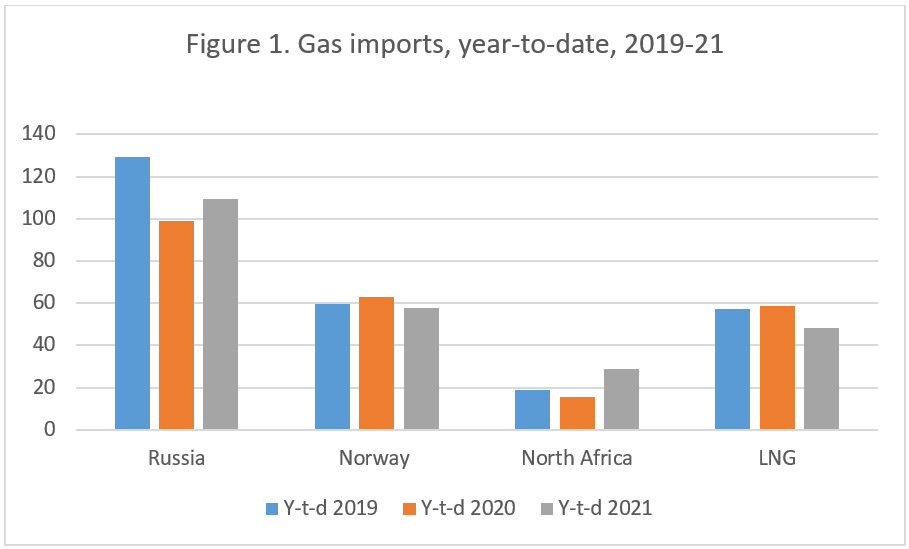

Russia’s gas exports in focus: ‘A year in two halves ?’ a contribution to the Natural Gas World Magazine charts on EU gas imports from Russia, Norway and LNG, Russia’s transit via Belarus and Ukraine, and LNG exports to Klaipeda FSRU

International Law firm Volterra Fietta organised a webinar The Energy Charter Treaty: is it still fit for purpose and how could it be improved?

New challenges in gas markets. “LNG: Intercontinental to inter-regional?” (Petroleum Economist, May 2020), stating that price differentials are threatening the economics underlying global LNG arbitrage. Bloomberg quotes Balesene’s analysis on small-scale LNG opportunities in times of low prices

Article: “New oil counter-shock: advent of uncertainties” for Vienna Institute of International Economics (WIIW), April 2020

The current slump in oil prices is a reflection of fundamental uncertainties and, unlike previous such episodes, will do little to boost economic growth. Its effect on oil-producing countries is likely to be asymmetric, with Russia lagging behind OPEC in terms of the competitiveness of its oil industry.

Andrei Belyi’s letter to the Financial Times in response to the FT article “Why Russian oil groups are well positioned for a price crash” (March 30)

Opinion: CNG vehicles are pivotal in the response to the combination of COVID and climate crisis, particularly in the Baltic states, where biomethane use in CNG is rising. See Andrei Belyi commentary in Dienas Biznes, 07.04.2020. Title: Auto ar gāzi kā zelta vidusceļš jaunajiem ekonomiskajiem izaicinājumiem

Interview: June 2019: Interview for Natural Gas World “Finding Common Ground in the Baltics”

Study:Stepping on the Gas: Future-Proofing Estonia’s Energy Market and Security

The Baltic region is making a significant progress in developing functioning regional natural gas market, expanding and integrating the related infrastructure, and ensuring the security of supply. However, there are multiple factors—at the national, regional, European and even global levels—that prevent this from becoming an ideal market capable of delivering greater security at a reasonable cost.

Blog Article “LNG: Developing the Demand” for the Centre for Climate Change, Energy and Environmental Law (University of Eastern Finland)

Focus on Central Asia: European Green Deal is a paradigm shift, arising opportunities and challenges for Central Asia, discussion on Kyrgyzstan’s state TV (in Russian)

Analysis: Changes in Russian oil rent, new social contract in Russia following taxation reform, blog for the International Centre for Defense and Security

“Changes in Russia’s political economy have triggered a shift in the collection of oil revenues by the Russian government.”

Presentation: Andrei Belyi delivers a speech at Thomson Reuters conference in Moscow on Small Scale LNG development

“The main caveat here is that ships are required to use lower sulphur fuels but refiners are not restrained by any regulation to supply heavier-but-cheaper solutions. Hence, ships will still have access to heavier fuels.”

Interview: Andrei Belyi discusses with Natural Gas World about new markets for cryogenic fuels